Many consumers are very frustrated with the monthly bills they pay. They want to know how can I lower my bills? I too had this same questions and discovered how I can lower my bills without too much work. There are lots of web sites out there that are focused on renegotiating mortgages and loans etc, but basically they want a piece of the action and they will end up costing you more money. There are lots of ways that you can knock a few dollars of a variety of things and end up saving hundreds of dollars a month. Some involve negotiating with the vender for a lower price, while others involve changing your habits so that your monthly bill is less.

Many consumers are very frustrated with the monthly bills they pay. They want to know how can I lower my bills? I too had this same questions and discovered how I can lower my bills without too much work. There are lots of web sites out there that are focused on renegotiating mortgages and loans etc, but basically they want a piece of the action and they will end up costing you more money. There are lots of ways that you can knock a few dollars of a variety of things and end up saving hundreds of dollars a month. Some involve negotiating with the vender for a lower price, while others involve changing your habits so that your monthly bill is less.

How Can I Lower My Bills

Ask for a Discount

We believe in the motto: “Always ask for a discount, the worst that will happen is that they say NO”!

Here is a Short list of Quick methods to Lower Bills

- Use less fuel

- Negotiate a new low interest rate mortgage

- Get a new Telecom plan

- Get a new Cable TV / Satellite TV plan

- Eat out less

- Buy Discount

- Take the bus

- Take your lunch to work

- Coupons

- Do It Yourself – DIY

Review all of Your Utility costs to Lower Your Bills

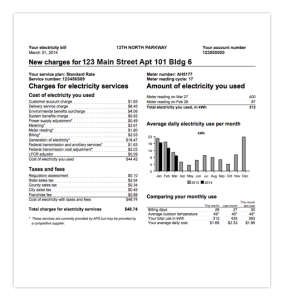

Water, Heating and electrical usage can not be negotiated since they are provided by city or large government agencies in many locations. But you can control these bills to some extent by managing your usage – turning the heat down at night during winter time and the AC up in the summer will make a significant difference on these bills. Dry your clothes in low cost time frames on the weekend and turn off lights in rooms that are not in use. Water usage can be reduced by migrating to low flow toilets shower heads and faucets.

Cable TV, Telephone, Mobile and Internet services can all be negotiated. First you need to do a little work to investigate what the competition will offer you if you were to switch accounts to another provider. Then approach your provider and ask them what they are willing to do. Inmost cases if you have your facts together, they will offer discounts over your current billing. I recently did this and saved almost a $100 a month! That is a lot and really contributes to lowering my bills.

Use less Fuel

Take the bus to work, walk more, keep your vehicle properly tuned and ensure that your tires are properly inflated. Plan your trips to reduce mileage, drive at the speed limit instead of 10 miles an hour over and avoid jack rabbit starts and stops.

Negotiate a new low Interest Rate Mortgage

If your currently paying a high interest rate, you may save some money and reduce your monthly bill as well by renegotiating your mortgage. There will be fee’s associated with a new mortgage, so compare this cost with what you are saving to ensure that overall your monthly bill is going to be less.

Eat out Less

Many people eat out 4 or 5 times a week or even more. Even cutting one of those times can save a lot in monthly costs. In some cases well over $100 per month. Eating in with the family can be fun to if plan properly

Buy Discount

Never pay full price for anything you buy unless it is an emergency situation. All items either go on sale at some point or they can be negotiated to a lower price. Be patient and save money by looking for the discounts.

Take your Lunch to Work

More and more people are eating out for lunch, yet you can save money by making your own. I know people who spend more than $10 every day for lunch, yet they could save at least half of that by making their own lunch. That would add up to around $100 a month in savings.

Coupons

Coupons are a big deal in some locations and not so much in others. Whenever you get the chance to save some money by using a coupon do it. We have all watched the reality shows , extreme couponing etc. You may not go that extent, but even if you save money each time you shop, it can add up.

Do It Yourself – DIY

This is potentially a big one and that is DIY or do it yourself. If you are not handy and not willing to learn it may not work for you. Many consumers save themselves thousands of dollars every year by doing repairs and renovations themselves. Teach yourself, talk to the experts, ask friends to help. Whatever it takes do it yourself, just make sure you know how to do the work safely and correctly.

These are lots of good ideas about how can I lower my bills. They may not all apply to everyone, but even if you can use one and save $100 a month your ahead of the game. Give us your comments about this post and how to lower your bills. If you leave a well written comment, we will even approve a link back to your own site if you have one.